How to Use Technical Indicators to Let Profits Run

Relative Strength Index or RSI is the most popular indicator of technical analysis. RSI is the oscillator that many traders rely as the accurate indicator of the stock's position. RSI helps to determine whether a stock is overbought or oversold. RSI has upper and lower bands that determine the strength of the stock. This indicator is also famous as the momentum indicator in the technical analysis.

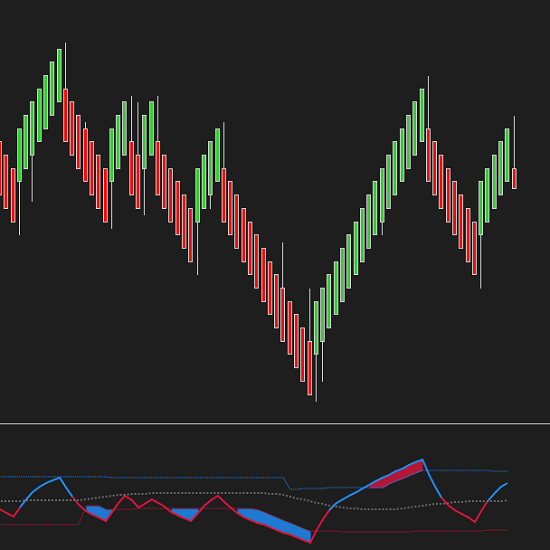

The plotting of RSI occurs on the scale of 0-100. A reading above 70 indicates overbought position whereas the reading below 30 indicates oversold position. Traders keep an eye on this indicator to spot the reversal in price. This indicator has been popular in determining the trend of the stock. The indicator is very useful in predicting the next move of the stock. It does not mean that as soon as RSI reaches 70 a stock becomes an ideal candidate for selling. Stocks can remain oversold or overbought for a long period of time.

The momentum indicator like RSI can only provide insight into the stock's performance. It is not advisable to rely on momentum indicators alone. Should you loved this article and you wish to receive more information regarding ninjatrader ichimoku kindly visit the web-site. The use of these indicators must be complemented by other tools of technical analysis. It is not advisable to jump to the conclusion about the performance of the stock purely on the reading of the indicators. These indicators are lagging indicators, and their readings might result in a false trade.

The momentum indicators are lagging indicators. Their readings are the result of the past performance of the stock price. They have the ability to spot the market reversals through divergences. A divergence occurs when the stock price is making a new high, but the indicator does not make a new high. It means the stock is losing the strength in its momentum signaling a quick reversal.

Traders use RSI to identify the continuation of the trend. This indicator provides clues for the next movement of the stock. A divergence in the indicator alerts the trader about the possible false move. It is clear that the momentum indicators are fairly accurate in analyzing the strength of the trend.

There is a word of caution for traders. The readings of these indicators must be in tandem with other indicators of technical analysis. It is possible to profit from the stock prices. The indicators are merely tools that guide the trading judgment of a trader. It can lead to highly profitable trades.